Stamp duty is a tax that you have to pay when buying property in England or Northern Ireland. The Bajaj Finserv Stamp Duty Calculator is designed to help you accurately assess the amount of stamp duty you will have to pay towards your property so that you know exactly how much home loan you need.

Stamp Duty Calculator How To Calculate Stamp Duty Using Ready Reckoner Youtube

Just use your physical calculator.

. You can use HM Revenue and Customs HMRC Stamp Duty Land Tax calculator to work out how much tax youll pay. Use our FREE Stamp Duty Calculator. You may be able to reduce.

If two or more documents arise from a single contract of sale or together form or arise from substantially one transaction or one series of transactions Section 67 of the Stamp Duties Act 1923 may result in duty being assessed on the total transaction considerationvalue. Paying this duty validates the registration of your property which acts as legal proof of ownership. First Time Buyer Purchase Price Enter numbers only Full Calculation PDF Moving Home Full Calculation PDF Additional Property Full Calculation PDF.

Using of e-stamp duty ready reckoner year wise which we have provided for the year 2015-16 2016-17 2017-18 and 2018-19 2019-20 2020-21 and 2021-22 from which you can search current and previous year ready reckoner rates applicable for calculation of government tax such as stamp duty registration fee along with guideline for calculating the market value of the property. Compute the stamp duty payable including Sellers Stamp Duty for the following types of documents. IPhone and iPad friendly.

This is 3 on top of the normal rate for each band in the table above. Stamp Duty Calculator Property Value StateTerritory Click Calculate every time you update the options. This stamp duty calculator will help you find the amount of stamp duty on your property in your respective State.

Punch the details of how much youre paying for your property where youre buying and when you expect to complete into our free calculator to see how much stamp duty youll need to pay. Calculate how much stamp duty you will pay. The Stamp Duty Calculator can help you find out if you might qualify for a Stamp Duty discount.

Stamp duty and registration charges are among the extra charges that need to be paid when you register ownership of your new house. Buy to Let and Second Home Stamp Duty Calculation. For a home priced over 500000 the standard rates of stamp duty will be payable as you wont qualify for first-time buyers relief.

Youll instantly be given a breakdown of how much Stamp Duty youll pay. Land transfer stamp duty calculator This calculator works out the land transfer duty previously stamp duty that applies when you buy a Victorian property based on. We take into account the region youre buying in the price of your property and whether youre a first time buyer or if this is a second home.

The date of the contract for your property purchase or if there is no contract the date it is transferred. This calculator has been revised in 2019. February 12 2019 0231 PM.

0 Total Government Grant 0 Financial Calculators VisionAbacus Pty Ltd 2022. When purchasing an additional property the stamp duty rate of 3 will be payable for properties priced between 40001 and 125000. We have developed a Stamp duty calculator for the people who are looking to buy property.

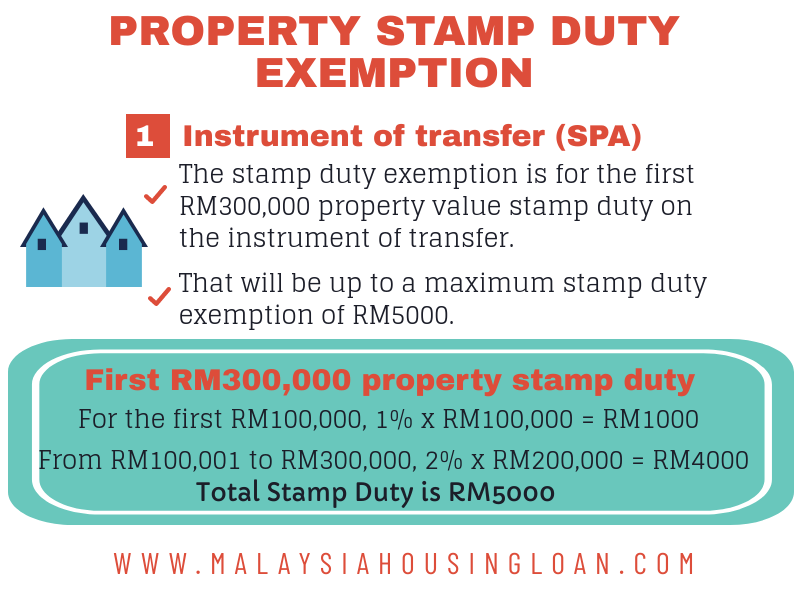

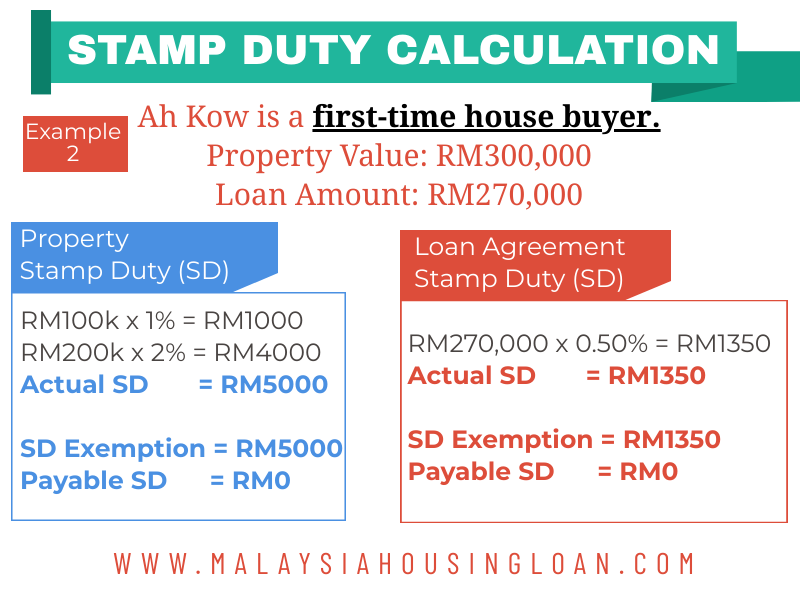

Stamp duty calculator 2019. Services for Real Estate Pros. If the loan amount is RM300000 the stamp duty for the loan agreement is RM300000 x 050 RM1500.

There is no stamp duty Tax applied to the first 125000 2 above 125000 5 above 250000 That equates to an overall rate of 38 of the sale price or 32500. First home buyers that buy NEW homes under 800000 will pay NO stamp duty from August 1st 2020 NSW Government announced. Stamp duty calculator Enter the price location and purpose of the property youre buying and our stamp duty calculator will tell you how much tax youll have to pay on it.

Select First Time Buyer Moving Home or Additional Property. Stamp Duty For Additional Properties If the property you are buying is what is known as an additional property then you will have to pay a higher rate of Stamp Duty. Primary Residence Investment 2 First Home Buyer.

Check stamp duty rates where you live. Do not forget to click Calculate button every time you update the options. Buying elsewhere in the UK.

Find Everything about Stamp duty calculator 2019 and Start Saving Now. Click Calculate button for instant stamp duty calculations. Refer to the Section 67 Document Guide.

3 Are you purchasing. The loan agreement Stamp Duty is 050 from the loan amount. Foreign Buyers Duty - we updated our calculator with Foreign Purchasers additional stamp duty for NSW 8 VIC 8 QLD 7 and WA 7.

It is a form of tax that a buyer needs to pay to the State government while buying a new property. For purchases over 40000 LTT is charged at 4 on the full purchase price up to 180000 75 on the portion between 180000 and 250000 9 on the portion between 250000 and 400000 115 between 400000 and 750000 14 within the. The change to the thresholds will only apply to newly-built homes and vacant.

Determine when your business is liable for GST registration for periods prior to 2019. The tool helps landlords and investors to calculate Stamp Duty Land Tax. What is Stamp Duty.

Use our Stamp Duty Calculator to work out how much Stamp Duty youll need to pay. How to calculate the new stamp duty rate Example Property purchase price. No Yes Total income of all purchasers Number of dependent children 0 1 2 3 4 5 Government Fees Stamp Duty on Property 414000 Mortgage Registration 16000 Transfer Fee 42900 Total Government Fees 472900 Government Grant First Home Owner Grant.

Stamp Duty Calculator for New South Wales. Freehold sales and transfers You can also use this table to work out the SDLT rate for a. The exemption applies for a maximum loan amount of RM300000.

Ad Look For Stamp Duty Calculator 2019 Now. The calculator below will provide you with a full breakdown of stamp duty land tax with numerous options whether you are a first-time buyer additional property purchaser buy to let or if you are buying under the shared ownership scheme. Use the SDLT calculator to work out how much tax youll pay.

You dont need a loan stamp duty calculator to calculate this.

What Is Stamp Duty In Hong Kong And How Much Is It Zegal

The Complete Guide To Stamp Duty

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

Indemnity Bond Fee Value Has Been Revised From Rs 80 To Rs 200 As Tamil Nadu Stamp Duty Act Notification 2019 Po Tools

Buyer S Stamp Duty Bsd Jeron Lee Division

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

Online Stamp Duty Calculator Check Latest Aug 2022 Rates Here

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Latest Stamp Duty Charges 6 Other Costs To Consider Before Buying A House In 2019 Cbd Properties

How To Calculate The Savings From Reduced Stamp Duty And Transfer Tax Dig Jamaica

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Legal Fees New Property Board

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook